Accounting Services

Comprehensive Property Accounting Services

Keeping our fingers on the financial pulse of each property is one of the most important ways we monitor the health and performance of your asset.

We carefully scrutinize all income and expense line items: including rental rates, tenant reimbursements, utility expenses, insurance premiums, property taxes and labor costs.

Alder leverages the latest technology, time-tested accounting procedures, and decades of experience to provide outstanding, clear and informative financial reporting.

Our clients, investors, even our own staff, benefit from our detailed and straightforward reports by being able to make informed decisions to maximize net operating income and long-term capital value.

Financial Reporting

ALDER operates on the cutting-edge Yardi Voyager® Software Platform, enabling us to provide institutional-quality financial reporting packages to our clients.

Owners and investors can rely on a complete monthly and annual assessment of the each property’s financial condition.

From easy-to-read summaries to transaction-level detail, the report packages provide all the information needed to gauge the performance of your asset.

ALDER’s financial report packages include:

- Budget Variance Reports

- Detailed Rent Rolls

- Tenant Aged Receivables

- Cash Flow Analysis

- Income Statements

- Balance Sheets

- Accounts Payable Ageing

- CAM Reconciliation Reports

- General Ledger

- Bank Reconciliations

- Retail Tenant Sales Analysis

Web-Accessible Accounting Portal

In addition to monthly financial report packages, owners may directly access the latest financials, tenant lease information and all property and portfolio-level data via the internet, through our web-based enterprise management system powered by Yardi Voyager®.

24/7 Web-Access to the Most Current Data

This level of access is helpful for all owners, including the broad brush big-picture client and especially useful for hands-on investors, partners and auditors that require direct access to detailed property data.

Users run customized financial reports, take advantage of special institutional-level analytic tools and view every transaction of interest.

Web Dashboards and Customized Analytic Tools

- Check the status of an owner distribution

- Run a mid-month aged receivable report

- View tenant, vendor or investor ledgers

- Review transactions related to certain expense categories

Find the information you need without waiting for a call or email from your manager.

Answer Questions Easily

- When does a particular lease expire? Is there an option to renew?

- Who hasn’t paid rent?

- Did the owner disbursement go out yet?

- What did we spend on roofing last year?

- How does this compare to the year before?

All one needs is a login and password, and the entire universe of information about a portfolio or asset is at your fingertips.

More Transparency = Better Decision Making

This web portal increases transparency, efficiency and helps all parties make informed decisions based on the most current and relevant property information.

Users that benefit from this scalable and cloud-based system include onsite staff, superintendents, owners, partners or auditors in any geographic location.

Tenant Billing

A manager’s ability to collect rental payments on time is one of the most important factors in ensuring consistent cash flow.

Collecting from Delinquent Tenants

Delinquent tenants receive phone calls, emails and notices when their rent is past due. When all other collection attempts are exhausted, we recommend legal action and work with local eviction attorneys.

Rent Check Depositing and Archiving

We make timely deposits and store images of all rent checks in ALDERAccess, our paperless document management system.

Detailed Statements

Tenants receive a detailed monthly statement reminding them where to send payment and detailing all of the charges due, including base rent, CAM charges, property taxes, utility sub-meter billings, percentage rent and late fees if applicable.

Budgeting

Why Budgeting is Critical

The property operating budget is an essential tool to help owners set and achieve financial goals.

How a Budget is Drafted and Approved

Preparing a well thought-out budget is a process that takes time and research. The property management team analyzes vendor contracts, historical expenses, proposed capital improvement projects, existing lease agreements, along with market leasing assumptions for vacant or rolling leases. This research culminates in the manager’s determination of the most likely income and expense amounts for the budged period.

Each income and expense line item shall correspond to a general ledger code and will have a corresponding written explanation of the assumptions used to arrive at the budged amounts shown in the notes section at the bottom.

The budget is most often shown in a month-by-month income statement format for the next budgeted period.

The benefits of a detailed budget plan are:

- Establishes Measurable Expectations – Ownership, investors and lenders can rely on the operating budget to establish realistic expectations for the property’s performance during the budgeted period, while noting the assumptions and contingencies for unanticipated income or expenses.

- Provides Spending Authority – Owner-approved budgets may set forth spending authority for the property management team for the year. Significant variances and exceptions above a pre-determined threshold would require additional owner approval.

- Helps Stabilize Cash flow – A detailed month-by-month projection is helpful when timing larger expenditures to avoid cash shortfalls and optimize distributable cash flow to ownership.

- Increases Accountability – Detailed variance reports included with the monthly report package identify income or expense line items that differ from budgeted amounts. Property managers can report to ownership as to why the variance is occurring.

A proposed budget formulated in Argus Software or Excel will be delivered prior to the start of each fiscal year.

Each budget includes the following:

- Income – A projection of expected income from all sources

- Expenses – An explanation for each expense account, including reasons for significant changes

- Capital Costs – A list and explanation of recommended capital improvements

- Financing – Recommendations for financing if necessary

- Owner’s Requirements – Important constraints upon the management plan caused by unusual requirements of the owners

- Market Leasing Assumptions –Inputting projected renewal rental rates, possible vacancy and the likelihood of incurring tenant improvement, leasing commissions and other concessions for units that are up for renewal in the budgeted year.

Budget Variance reporting is included in each Monthly Report Package which shows how the actual expenditures differ from the budgeted amounts.

Accounts Payable

ALDER processes payments to all vendors guided by controls and procedures established for each property.

Our process insures that each payment conforms to the budget approved by ownership. All invoices must go through an approval workflow to insure all appropriate management staff has reviewed and signed off on each invoice before it is paid.

In the event an invoice exceeds the budget, or a dollar value threshold agreed to by ownership, owner approval will be obtained prior to payment.

ALDER collects W-9s for each payee before processing payments in excess of the limits set forth by the IRS. At the end of the calendar year, 1099s are issued to vendors when required.

Disbursements to Owners & Investors

At the owner’s direction, ALDER can make cash flow distributions to owners and investors. We can help abstract complex operating agreements and calculate distribution amounts that take into account promote structures, preferred returns, IRR calculations and asset management or operating partnership fees.

We work with owner’s tax accountants by providing a history of distributions and relevant figures to maintain accurate capital accounts and K-1 forms.

Retail Sales Tracking

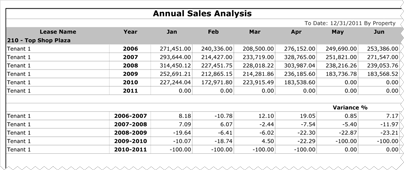

Monitoring the health of retail tenants by analyzing store sales figures, is critical towards fostering intelligent real estate decision making.

How Financially Healthy Are Your Tenants?

Owners and managers must know whether their tenants’ sales are trending up or down and if their total rent and occupancy costs are within a healthy range as a percentage of total sales revenue (health ratio).

ALDER provides detailed sales analysis reports that track various metrics, including sales per square foot, sales as a percentage of occupancy cost and variances with prior years’ sales. These reports are included in our comprehensive monthly owner report packages.

How We Use Store Sales Data to Make Decisions

Understanding this data is crucial in planning for possible vacancies of struggling tenants, anticipating the exercising of kick-out rights or applying leverage with successful tenants when negotiating lease renewals.

Archiving Sales Correspondence

ALDER enforces all tenant reporting requirements in accordance with the leases. We collect and archive the actual tenant sales correspondence inside of ALDERAccess for easy review and auditing.

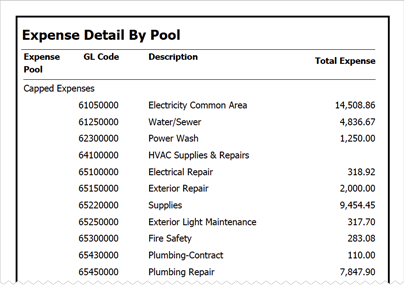

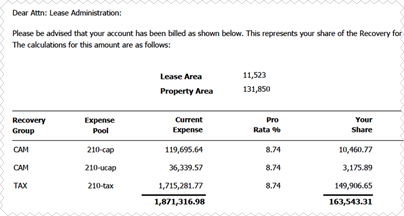

CAM Reconciliations

Properly billing commercial tenants for Common Area Maintenance (CAM) charges is vitally important to generate the most revenue possible, thereby maximizing net operating income and ultimately capitalized value.

We streamline complex CAM calculations

CAM calculations can become quite complex, as charges and recovery methods may vary widely from lease to lease. We take into account any capped expenses, differing pro-rata share calculations, base year overages and administrative or management charges.

The key to accurately billing for CAM begins with thoroughly abstracting each tenant’s lease and then capturing the details of all CAM calculation parameters into the accounting system.

This process includes creating appropriate expense pools and choosing which expense codes from the general ledger are billable in each pool. Lastly, caps and base year information are taken into account when necessary.

Determining Estimated CAM

Most tenants are billed monthly estimates based on their pro-rata share of the approved budget. Depending on the lease language, other tenants may be billed upon landlord’s receipt of a bill, as is often the case with property taxes.

Recovery Reconciliations

At the end of each fiscal year, a comprehensive reconciliation is performed to true-up the tenant’s estimated payments with their share of the actual expenses paid during the prior year.

The difference is either paid to the landlord, in the event of an under-billing, or a credit is given to the tenant if their estimated payments exceeded the actual costs.

CAM Reporting and Auditing

A comprehensive reconciliation report is provided to each tenant showing how their share was calculated. If they wish to audit their billings, an excerpt of the general ledger is sent along with an organized zip file containing copies of all invoices and bills to support each expense. The zip file is sorted into subfolders by GL expense code for easy viewing.